Topic 3 - International economics

Question 1

SLPaper 2Japan–European Union Economic Partnership Agreement (JEEPA)

-

In July 2017, the Japan–European Union Economic Partnership Agreement (JEEPA) was announced and it may come into force in 2019. Jointly, Japan and the European Union (EU) currently account for 28 % of global gross domestic product (GDP). The trade agreement could raise the EU’s exports to Japan by 34 % and Japan’s exports to the EU by 29 %. Economists say that this trade agreement marks a determined effort to combat rising protectionism and sends a powerful signal that cooperation, not trade protection, is the way to tackle global challenges.

-

The largest benefit to Japan will be for Japanese car manufacturers, as Europe will gradually lower tariffs from 10 % on Japanese cars. Car tariffs are a big concern for Japanese car manufacturers, who struggle to compete with South Korean car manufacturers. South Korean cars are sold to the EU tariff-free thanks to a free trade agreement signed in 2011. Within Europe, car manufacturers are one of the largest sources of jobs. Car manufacturers in the EU are concerned that cutting tariffs on car imports from Japan may lead to a large increase of Japanese cars into the European market.

-

The trade agreement will also resolve non-tariff barriers, such as technical requirements and regulations. More importantly, however, the EU and Japan will make their environmental and safety standards on cars the same, which will make trade easier.

-

Japanese politicians have been defending their relatively inefficient farmers for a long time. Now, Japan will lower tariffs on European meat, dairy products and wine, cutting 85 % of the tariffs on food products coming into Japan. This includes removing the current 30 % tariff on some European cheeses, such as cheddar and gouda cheese. However, imported camembert cheese will face a quota. This may be because Japan produces some camembert cheese.

-

JEEPA is particularly alarming for United States (US) beef and pork farmers because Japan has been the biggest export market for US beef and the second biggest export market for US pork. Any preferential tariff that EU farmers receive will make it much tougher for American farmers to sell meat in Japan.

-

With this trade agreement, the EU and Japan are trying to promote the values of economic cooperation and environmental conservation, which are both important for long-term economic growth and sustainability. However, JEEPA faces significant challenges because it will have to be passed by the Japanese Parliament, the European Parliament and European national governments. There is no guarantee that all governments will agree to the economic partnership.

[Source: adapted from The Japan-EU Trade Agreement: Pushing Back Against Protectionism, http://globalriskinsights.com,

15 July 2017; Japan-EU trade agreement may hurt U.S. meat producers, by Katherine Hyunjung Lee, Jul 12, 2017, Medill

News Service, https://dc.medill.northwestern.edu; and A new trade deal between the EU and Japan, The Economist (London,

England), Jul 8th 2017, https://www.economist.com/finance-and-economics/2017/07/08/a-new-trade-deal-between-the-eu-andjapan.

© The Economist Newspaper Limited, London, July 8th 2017]

Define the term quota indicated in bold in the text (paragraph [4]).

Define the term sustainability indicated in bold in the text (paragraph [6]).

Using an AD/AS diagram, explain the impact of the trade agreement between Japan and the EU (JEEPA) on Japan’s economic growth (paragraph [1]).

Using an international trade diagram, explain the likely impact of Japan “removing the current 30 % tariff” on the level of cheddar cheese imports. (paragraph [4]).

Using information from the text/data and your knowledge of economics, evaluate the possible consequences of the trade agreement between Japan and the EU (JEEPA).

Question 2

SLPaper 2New Zealand dollar overvalued

-

The New Zealand finance minister said the exchange rate of the New Zealand dollar (NZD), is “unsustainably high; it is somewhere between 10 % to 15 % overvalued”.

-

The NZD had been near its record high against the US dollar before weakening last week on slower inflation figures and a fall in dairy prices. The NZD has gained about 6 % so far this year.

-

However, the finance minister said that New Zealand exporters had developed strength because of the high currency. “New Zealand is actually in reasonably good shape,” he said. “We have had an export sector operating with a strong exchange rate now for five or six years and that has had an impact on efficiency.”

-

An economist said recently that the central bank might consider intervening in the currency market to achieve a depreciation in the value of the NZD.

-

The Reserve Bank (central bank) governor raised the official interest rate for the fourth time this year to 3.5 % at a time when other major economies have their rates at record low levels.

-

He said that, “Encouragingly, the economy appears to be adjusting to the monetary policy tightening that has taken place since the start of the year. It is important that inflation expectations remain contained. This interest rate increase will help keep future average inflation near the 2 % target and ensure that the economic expansion can be sustained”.

-

New Zealand’s economy is expected to grow at an annual pace of 3.7 % over 2014. New Zealand government figures showed a monthly trade (in goods) surplus of 371 million in June 2013. The annual trade (in goods) balance turned to a surplus of 819 million a year earlier.

-

Global demand for New Zealand dairy products has been a key support for the country’s exports over the past 18 months, though prices have dropped this year with increased supply.

Define the term depreciation indicated in bold in the text (paragraph[4]).

Define the term monetary policy indicated in bold in the text(paragraph[6]).

Using an exchange rate diagram, explain how the increase in the official interest rate to 3.5 % is likely to affect the value of the New Zealand dollar (paragraph[5]).

Using an AD/AS diagram, explain how “monetary policy tightening” may affect a country’s inflation rate (paragraph[6]).

Using information from the text/data and your knowledge of economics, discuss the possible economic consequences of an overvalued New Zealand dollar on the New Zealand economy.

Question 3

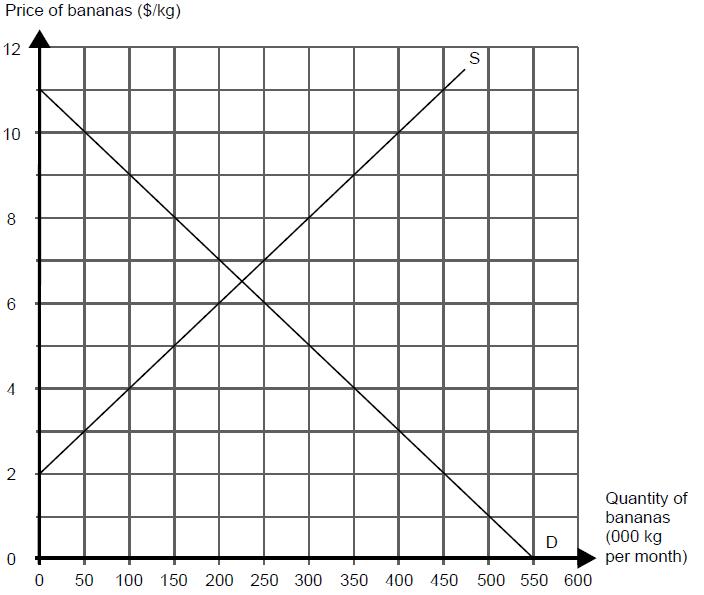

HLPaper 3The following diagram illustrates the market for bananas in Country A. D and S represent the domestic demand and supply for bananas, while bananas can be imported at the current world price of $3 per kg.

The government of Country A decides to impose a quota on banana imports of 150 000kg per month.

The demand and supply functions for the currency of Country A (the dollar ($)) are given by:

Qd = 1900 - 18P

Qs = 580 + 12P

where Qd is the quantity of dollars demanded per month, Qs is the quantity of dollars supplied per month and P is the price of the dollar, measured in yen (¥).

The following table provides selected items of the balance of payments for Country A in 2015.

Table 1

Assuming that there are no restrictions on the importing of bananas into Country A:

State the quantity of bananas which will be purchased each month in Country

Assuming that there are no restrictions on the importing of bananas into Country A:

Calculate the monthly expenditure on bananas imported into Country

Assuming that there are no restrictions on the importing of bananas into Country A:

Calculate the domestic producer surplus.

Identify the price which would be paid by consumers in Country A per kg of bananas following the imposition of the quota.

Identify the quantity of bananas which would be purchased in Country A per month following the imposition of the quota.

Calculate the change in revenue earned by domestic producers of bananas in Country A as a result of the quota.

With reference to the diagram, explain why the welfare loss from the imposition of the quota is likely to be greater than the welfare loss resulting from a tariff of $2 per kg.

Outline the reason why a fall in the price of the dollar should lead to an increase in the quantity of dollars demanded.

Assume that the dollar/yen exchange rate is in equilibrium. Using the functions, calculate the cost, in dollars, of a motorbike which costs ¥552 640.

Using examples from Table 1, outline the difference between debit items and credit items in the balance of payments.

Calculate the current account balance from the data given in Table 1.

Explain two implications of a rising current account surplus.

Question 4

HLPaper 2Current account deficit poses a challenge to Pakistan’s economy

-

The president of Pakistan has expressed his concern at the significant increase in Pakistan’s current account deficit. The current account deficit grew to US4.86 billion in 2015/16. The deficit was caused by rising imports and falling exports. The increasing current account deficit may result in Pakistan having to request a new International Monetary Fund (IMF) loan to fund the deficit. To avoid this, the president is proposing that the importing of luxury, non-essential items needs to be reduced.

-

The governor of Pakistan’s central bank agreed with the president’s concern. He said that the “rapidly growing current account deficit is the biggest challenge facing the country’s economy”. He agreed that the problem is made worse because many non-essential imports are being purchased, which requires borrowing from abroad. However, he stressed that while rising non-essential imports are a problem, “32 % of imports are capital goods” and are necessary for the continued growth of small to medium enterprises (SMEs), agriculture, housing and construction.

-

Central bank advisors have also recommended depreciating the rupee (Pakistan’s currency) to reduce the trade deficit. The value of the rupee is currently controlled through a managed exchange rate system. It has been suggested that the rupee is overvalued by as much as 20 %. However, the central bank governor claims that a “depreciation has a number of negative effects”.

-

In 2016, Pakistan’s economic growth reached 5.3 %, its highest point for 10 years. The government has estimated that it will be 6 % in 2017. According to the central bank governor, loans to SMEs are currently only 7 to 8 % of all loans to businesses in Pakistan. He believes that if loans to SMEs were increased to 15 to 17 % of all loans to businesses in Pakistan, there would be even higher economic growth.

-

Along with the current account deficit, fiscal policy decisions have also led to a significant budget deficit. The budget deficit increased in 2016, resulting in greater public debt. The central bank recommends the government’s debt to be limited to 60 % of gross domestic product (GDP).

[Source: adapted from Current account deficit may lead to IMF loan: FPCCI chairperson, https://www.thenews.com.pk/

print/226102-Current-account-deficit-may-lead-to-IMF-loan-FPCCI-chairperson and Current account deficit poses biggest

challenge to economy: SBP, https://www.thenews.com.pk/print/225481-Current-account-deficit-poses-biggest-challenge-toeconomy-

SBP. Copyright © The News International, Karachi, Pakistan.]

List two functions of the central bank (paragraph [2]).

Define the term fiscal policy indicated in bold in the text (paragraph [5]).

Using an exchange rate diagram, explain how the central bank might depreciate the value of the rupee(paragraph [3]).

Explain the difference between a current account deficit and a budget deficit (paragraph [5]).

Using information from the text/data and your knowledge of economics, discuss the effects of the increasing current account deficit on Pakistan’s economy.

Question 5

SLPaper 2Ghana to seek help from International Monetary Fund

-

Ghana has said it will seek financial aid in the form of a loan from the International Monetary Fund (IMF) to help stop the rapid decline in the value of the cedi, Ghana’s currency, and close a large budget deficit. Ghana’s transformation from one of Africa’s fastest growing economies to the home of the world’s worst-performing currency has become a concern. The exchange rate depreciated by 40 % against the US dollar in 2014. The fall in the currency has led to increases in the price of consumer goods such as sugar and fuel;

inflation is at an unacceptable 15 %. -

Despite being a major exporter of gold, oil and cocoa, Ghana’s current account deficit has risen sharply to 12 % of its gross domestic product (GDP). This is partly due to a rapid increase in demand for imports and falling gold prices. Additionally, oil revenues have not been as strong as expected.

-

The government is also struggling with a wide budget deficit, which stood at 10 % of GDP last year. Ghana’s good reputation for fiscal responsibility has worsened considerably as the government tripled salaries for police officers and soldiers.

-

It is expected that the news of talks with the IMF will be positively received in international financial markets. The finance minister has said the step would help to stabilize the currency, to bring domestic prices under control, and also to restore investors’ confidence in Ghana’s economy.

-

A Ghanaian spokesperson noted that the IMF would insist on the government introducing measures to tackle inflation and reduce its budget deficit. The IMF says that Ghana needs to tighten its budget immediately, by reducing public sector wages, lowering subsidies and increasing taxes. The IMF is likely to demand a limit on borrowing and perhaps some privatization of power and water companies.

-

Earlier this year, problems in the economy had led to nationwide protests, with thousands of workers across the country protesting in the streets about the rise in the cost of living. The country’s largest trade union says the government has been mismanaging the economy. In response to the protests, a government minister said that the government would work very hard to achieve economic development to make life easier for the working people of Ghana but that all Ghanaians would have to make “some sacrifices for the economy to recover”.

Define the term budget deficit indicated in bold in the text (paragraph[1]).

Define the term economic development indicated in bold in the text (paragraph[6]).

Using an exchange rate diagram, explain how the large current account deficit may have affected the value of the Ghanaian cedi.

Using an AD/AS diagram, explain how the falling value of the Ghanaian cedi may have contributed to inflation.

Using information from the text/data and your knowledge of economics, discuss possible consequences of International Monetary Fund (IMF) financial aid on Ghana’s economic growth and development.

Question 6

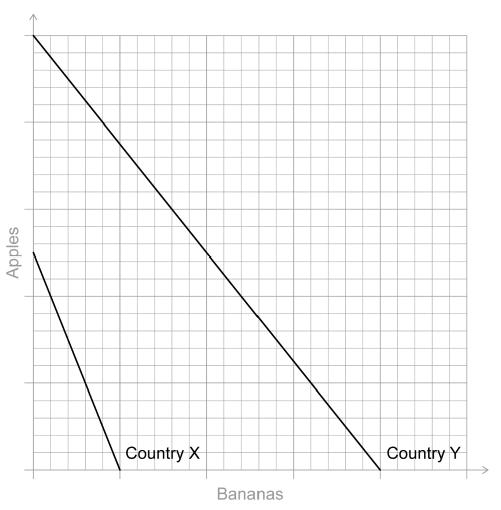

HLPaper 3Country X and Country Y are capable of producing both apples and bananas. Assume a two-country, two-product model.

Country Y has absolute advantage in the production of both apples and bananas, and comparative advantage in the production of bananas.

The market for oranges in Country Z is illustrated on Figure 5.

Figure 5

The domestic demand and supply for oranges are given by the functions

Qd = 300 − 100_P_

Qs = − 60 + 60_P_

where P is the price of oranges in dollars per kilogram ($ per kg), Qd is the quantity of oranges demanded (thousands of kg per month) and Qs is the quantity of oranges supplied (thousands of kg per month). The world price of oranges is $2 per kg.

Due to increased awareness of the possible health benefits of vitamin C, the demand for oranges in Country Z increases by 60 000 per month at each price.

Tanya is a currency speculator. She buys and sells currencies with the intention of making gains as a result of changes in the exchange values of currencies. Currently, she is holding US$300 000, but she expects that in the next few months the euro (EU€) (the currency of the eurozone) will appreciate against the US dollar (US$).

At present, EU€1 = US$1.20.

Tanya exchanges her US$ for EU€.

The EU€ depreciates by 10 % against the US$. Fearing further depreciation of the EU€, Tanya exchanges her EU€ for US$.

Sketch and label a diagram to illustrate comparative advantage between Country X and Country Y on Figure 4.

Figure 4

Outline the reason why Country X should specialize in the production of apples and Country Y should specialize in the production of bananas.

Outline one reason why it might not be in a country’s best interests to specialize according to the principle of comparative advantage.

Calculate the change in expenditure on imported oranges as a result of the increase in demand.

Calculate the change in consumer surplus in Country Z as a result of the increase in demand for oranges.

Calculate the change in social (community) surplus as a result of the increase in demand for oranges.

State one administrative barrier that Country Z could use in order to restrict imports.

Explain two possible economic consequences for the eurozone if the euro appreciates.

Calculate the quantity of EU€ she will receive for her US$300 000.

Calculate, in US$, the loss made by Tanya as a result of these transactions.

Explain two reasons why a government might prefer a floating exchange rate system for its currency.

Question 7

HLPaper 2The Comprehensive and Progressive Agreement for Trans-Pacific

Partnership (CPTPP), Australia and Japan

-

In 2018, Australia signed the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)*. The agreement creates the third largest free trade area in the world, covers nearly 500 million people and is worth more than US$12 trillion. The members of the agreement have stated that economic integration and free trade is important to help foster good political relations and inclusive growth for all nations.

-

The trade agreement will aim to gradually eliminate most trade protection within the member countries. The agreement will see tariffs eliminated for Australian cheese and beef exports to Japan, and increased quotas for the export of rice to Japan from 4400 to 8400 tonnes. Nikkei Asian Review reported that “Fast-food restaurants in particular are embracing the import as a way to cut costs to cope with rising wages.” Additionally, Japanese food manufacturers will be able to lower production costs for rice-based meals and benefit from increased stability of input prices. The benefits from the agreement for Japan’s economy are projected to exceed US$70 billion, but some industries would be negatively affected.

-

Japanese farmers are worried about the increase in imported food from Australia. Furthermore, the Japanese government is concerned about the effects of the CPTPP on Japan’s food self-sufficiency—Japan relies on other countries for over 60 % of its food. In response to these concerns the Japanese government has offered support for domestic farmers to diversify production into other crops. The government also plans to subsidize the rice farmers through the initial phase of lowering trade barriers.

-

The agreement is said to be worth more than US$37 billion to Australian agricultural exports. It is hoped that CPTPP and the falling value of the Australian dollar will help Australia to reduce its current account deficit, but some economists have argued that this can take a long time. According to some estimations, the short-run price elasticity of demand (PED) for Australian exports is 0.2 and the short-run PED for imports in Australia is 0.4. However, the long-run PED for Australian exports is 1.1 and the long-run PED for imports in Australia is 1.3.

-

There have also been concerns about the CPTPP from trade unions in Australia. They argue that it deregulates the labour markets and gives corporations from other countries an ability to take legal action against governments for implementing laws that raise wages or protect the environment, if the foreign corporation can prove that the law hurt their commercial interests. One university lecturer said that the future costs to the taxpayer could be significant if foreign companies take the Australian government to court.

-

The trade agreement would allow workers from other countries to work in Australia without employers being required to check if Australian citizens are available to fill the jobs before the migrant workers are employed. It is estimated this may risk 39 000 jobs in Australia. Furthermore, environmental activists have expressed concerns that the negative environmental and social effects of the agreement have not been well considered. This may lead to conflicts with Australia’s commitment to the United Nations’ Sustainable Development Goals.

Adapted from Karp, P., 2017. Revived Trans-Pacific trade deal undercuts Australian jobs market, unions say. The

Guardian, Copyright Guardian News & Media Ltd 2021, https://www.theguardian.com/australia-news/2017/dec/19/

revived-trans-pacific-trade-deal-undercuts-australian-jobs-market-unions-say; Kodachi, H., 2019. Australian rice

finds favor in Japan as cheaper option, Nikkei Asian Review, https://asia.nikkei.com/Business/Markets/Commodities/

Australian-rice-finds-favor-in-Japan-as-cheaper-option.

* The CPTPP includes eleven member countries: Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam.

Define the term free trade area indicated in bold in the text (paragraph [1]).

Define the term quotas indicated in bold in the text (paragraph [2]).

Using price elasticity of demand (PED) data from the text and the J-curve effect, explain the most likely impact of “the falling value of the Australian dollar” on Australia’s current account (paragraph [4]).

Using an international trade diagram, explain how “increased quotas for the export of rice to Japan” will affect the price of rice in Japan (paragraph [2]).

Using information from the text/data and your knowledge of economics, evaluate the view that free trade is beneficial to Japan’s economy.

Question 8

SLPaper 2Angola and Namibia

-

Angola and Namibia are neighbouring countries on the west coast of Africa.

Angola

-

Angola’s economy is driven by its oil sector. It is the second largest oil producer in Africa. Oil production and its supporting activities contribute about 50% of gross domestic product (GDP), more than 70% of government revenue and more than 90% of the country’s exports. Diamonds contribute an additional 5% to exports. Subsistence agriculture provides the main livelihood for most people in Angola, but half of the country’s food is still imported.

-

Since 2005, the Angolan government has borrowed billions of US dollars from China, Brazil, Portugal, Germany, Spain and the European Union (EU) to help rebuild Angola’s infrastructure. The global recession that started in 2008 slowed economic growth. In particular, lower prices for oil and diamonds during the global recession slowed GDP growth to 2.4% in 2009, and many construction projects stopped.

-

Falling oil prices and slower than expected growth in non-oil sectors have reduced growth prospects for 2015. Angola has responded by reducing government subsidies and by proposing import quotas and making it more difficult to import. Domestic fuel subsidies have been eliminated. Corruption, especially in the mining sector, is a major long-term challenge.

Namibia

-

Namibia’s economy is heavily dependent on the mining and processing of minerals for export. Mining accounts for 11.5 % of GDP, but provides more than 50% of foreign exchange earnings. Namibia is a primary source for high-quality diamonds. In addition, Namibia is the world’s fifth-largest producer of uranium, produces large quantities of zinc and is a smaller producer of gold and copper. The mining sector employs less than 2% of the population. Namibia normally imports about 50% of its grain requirements.

-

A high per capita GDP, relative to the region, hides one of the world’s most unequal income distributions. The Namibian economy is closely linked to South Africa with the Namibian dollar pegged one-to-one to the South African rand. Namibia receives 30% to 40% of its revenues from the countries in the Southern African Customs Union (SACU). Angola is not a member of the SACU.

-

Namibia’s economy remains vulnerable to world commodity price fluctuations and drought. The rising cost of mining diamonds, increasingly from the sea, has reduced profit margins. Namibian authorities recognize these issues and have emphasized the need for diversification.

Figure 1: Selected economic data for Angola and Namibia (2014)

[Sources: adapted from www.commons.wikimedia.org, 14 August 2014; The World Factbook, Country Reports,

Central Intelligence Agency, 2015; www.databank.worldbank.org, accessed 13 August 2015 and www.cia.gov, accessed 13 August 2015]

Define the term infrastructure indicated in bold in the text (paragraph 3).

Define the term customs union indicated in bold in the text (paragraph 6).

Angola and Namibia have different Gini coefficient values. Using a Lorenz curve diagram, explain what this means (Figure 1).

Using a demand and supply diagram, explain the effect on the price and quantity of fuel consumed in Angola, caused by the elimination of domestic fuel subsidies (paragraph 4).

Using information from the text/data and your knowledge of economics, compare and contrast factors that are likely to lead to economic development in Angola and Namibia.

Question 9

HLPaper 2South Sudan joins the East African Community

-

The East African Community (EAC) is the most integrated trading bloc in Africa. In 2005, the members established a customs union, and then in 2010 it became a common market. There are ambitious plans to establish a monetary union by 2024.

-

According to a recent report, the region is wealthier and more peaceful as a result of the increased integration. Economic models suggest that bilateral trade between member countries was 213 % higher in 2011 than it would have been without the integration. This is despite the fact that progress on fully eliminating trade barriers has been rather slow and there are still a large number of non-tariff barriers.

-

Until recently the customs union was made up of Burundi, Kenya, Rwanda, Tanzania and Uganda. Very recently, South Sudan joined the bloc. This presents a tremendous opportunity for South Sudan, which was recently recognized as an independent country.

-

South Sudan is one of many developing countries that are dependent on oil exports for the majority of its export revenues and oil prices have been falling due to increased supply of oil in the market. The deteriorating terms of trade have resulted in a worsening of the current account and lower government revenues. Regional economic integration might help South Sudan to diversify its economy.

-

Agriculture is one potential area that South Sudan could focus on to diversify its economy. According to some estimates, 70 % of land is suitable for agriculture, but less than 4 % is currently being cultivated. The large flood plains in the country are suitable for rice production and the hope is that South Sudan can develop a comparative advantage in this essential food.

-

South Sudan is landlocked and most of its road network is unpaved. This is just one example of its poor infrastructure. Since infrastructure is an expensive investment, regional cooperation will be vital for improving its road systems. Furthermore, effective transport links to sea ports in Kenya and Tanzania will allow for greater trade and therefore economies of scale.

-

In the short term, there will be challenges for South Sudan associated with joining the common market. For example, before Rwanda joined the EAC in 2007, there were lower tariffs on many imported inputs. However, the cost of living for the poor population rose because of trade diversion that occurred after joining the EAC. South Sudan is likely to face the same problem.

-

Labour costs in South Sudan are higher than those of other member countries and years of conflict have left the population with low levels of education and skills. This may present a barrier for South Sudan in attracting foreign direct investment, despite being part of the common market.

Figure 1: Intra-East African Community* trade in goods (USD$bn)

* Burundi, Kenya, Rwanda, Tanzania and Uganda.

Not including South Sudan, which acceded to the treaty in 2016.

Define the term monetary union indicated in bold in the text (paragraph [1]).

Define the term comparative advantage indicated in bold in the text (paragraph [5]).

Explain why “deteriorating terms of trade have resulted in a worsening of the current account” in South Sudan (paragraph [4]).

Using a cost diagram, explain how membership in the common market may allow producers in South Sudan to gain economies of scale (paragraph [6]).

Using information from the text/data and your knowledge of economics, evaluate the likely impact on South Sudan of its membership of the EAC common market.

Question 10

SLPaper 2Unwanted consequences of United States–China trade war

-

In order to reduce its trade deficit, the United States (US) announced tariffs of 25 % on imports of steel and 10 % on imports of aluminium from various countries in March 2018. The US government also accused China of unfair trade practices and wants China to import more American-made products.

-

In July 2018, the first tariff on Chinese imports took effect and the Chinese government retaliated with a ban on US soybeans. In response, the US threatened to impose additional tariffs on imports worth almost US$300 billion, including a 25 % tariff on cars and car parts. This would be very damaging to the Chinese economy, which is slowing down, and workers in some provinces have become unemployed.

-

The trade war has also caused anxiety in the European Union and Australia, which are likely to see their trade with China affected. Global trade in goods has been slowing, with exports from trade-dependent nations (such as Japan and South Korea) to China declining. Economists have estimated that other countries could see exports to China drop by as much as 20 %. As of early 2019, Germany’s economy is almost in recession, partly because of the slowing Chinese economy. If the US imposes its threatened car tariffs, a recession in Germany is inevitable.

-

In the US, concerns were raised that the trade war has reduced business confidence. The decrease in demand from China, which results partly from trade tensions, has hurt the profits of US companies such as Apple Inc. and Caterpillar Inc. On the other hand, consumers and producers in the US are switching to domestically-produced goods due to the higher prices of some imported products from China.

-

In an attempt to reduce the risk of a sharp economic slowdown, China’s central bank eased monetary policy. Economic data showed that small- and medium-sized manufacturing companies saw the largest negative impact from the slowdown of its economy. Therefore, the government changed the definition of a “small business”, allowing more firms to have access to subsidized lending by state-owned commercial banks.

-

As the impacts of tax cuts enacted in the US in 2017 are disappearing, the US government is becoming more aware that the US economy is hurt by the trade war and is heading towards slower growth.

[Source: Adapted from Tang, F. and Wang, O., 2019. China prepares for testing 2019 by freeing up US$210 billion in latest

move to boost ailing economy. South China Morning Post, https://www.scmp.com/economy/china-economy/

article/2180758/china-prepares-testing-2019-freeing-us210-billion-latest-move; and Donnan, S., 2019. U.S.-China

Negotiations Risk Shutting Out the Rest of the World. Bloomberg Businessweek, https://www.bloomberg.com/news/

articles/2019-02-28/u-s-china-negotiations-risk-shutting-the-rest-of-the-world-out. Used with permission of Bloomberg

LLP Copyright © 2021. All rights reserved.]

Define the term tariff indicated in bold in the text (paragraph [2]).

Define the term trade war indicated in bold in the text (paragraph [3]).

Using an international trade diagram, explain the outcome on US producers of the introduction of a tariff on imports from China (paragraph [2]).

Using an AD/AS diagram, explain the desired impact of China’s “eased monetary policy” on its economic growth (paragraph [5]).

Using information from the text/data and your knowledge of economics, discuss the arguments for and against the trade protection measures imposed by the US on China.